Сегодня нам предстоит выяснить, какие льготы have old-age pensioners. How can they be issued in Russia? The retirement age in the Russian Federation offers modern elders quite a lot of privileges. Some of them were eliminated in 2017, but the bulk of government bonuses still remained. What can be expected after registration of a pension? What are the benefits from the state in one way or another? All this will be discussed below!

What benefits do old age pensioners have in Russia? To date, all government support can be divided into several categories. In each of them there are their benefits.

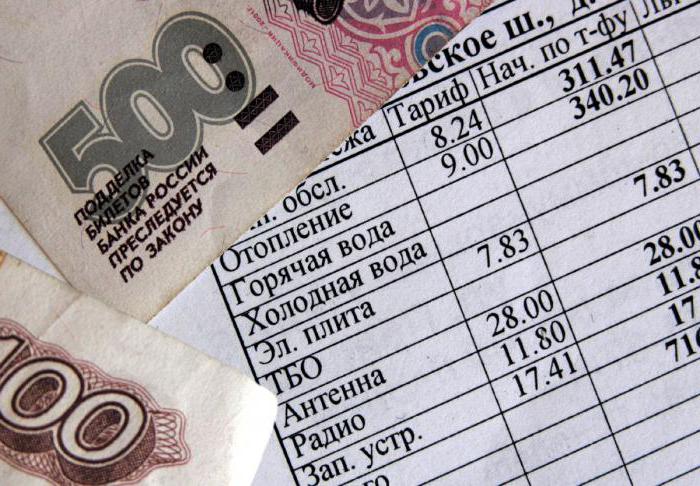

At retirement age, citizens have the right to design the following state support:

Also, under certain circumstances, retirees can draw up tax deductions by age. This is a fairly common phenomenon, occurring mainly among the working population.

What benefits do old age pensioners have? Some bonuses from the state depend on the region of residence of the citizen. But the bulk of them remain at the federal level.

Let's start with the most common scenario - tax breaks. To date, retirees can apply for:

In some regions of the Russian Federation provides for a completeexemption of pensioners from land tax. For example, such a measure was introduced in St. Petersburg and Perm. And the old people of the Moscow region are fully exempt from paying transport tax for cars of low power and domestic production.

Among the benefits provided to retirees in old age, you can highlight tax deductions. For example, property. Any working pensioner can issue them for himself according to generally accepted rules.

Non-working elderly people are entitled to a tax deduction of the property and social type for 3 years from the date of their dismissal.

Deduction can be obtained for:

How to issue these deductions will be discussed later. But on this benefits for pensioners do not end. There are bonuses worthy of attention.

What are the benefits for retirees in Primorsky Krai and other regions of the Russian Federation guaranteed by the state? There are a lot of them. The following bonus applies only to working pensioners.

The thing is that at the request of the pensionerThe employer is obliged to provide the employee with leave without pay at the time convenient for the applicant. The term of additional rest varies depending on the category of beneficiary.

Namely:

Registration is reduced to applying for leave to the employer. There is nothing difficult or special about it.

Benefits for old-age pensioners are different. We can say that in almost every area in everyday life, you can get one or other bonuses.

A huge role for older people play housing benefits. Needy and military retirees are entitled to:

Registration is reduced to the submission of documents to the management company. After that, pensioners will be able to take advantage of all housing privileges.

Documents required are as follows:

This is usually enough. Also, the citizen will have to emphasize their special position with certificates of recognition as needy, disabled or a military retiree. As a rule, this is no problem.

What benefits do Moscow pensioners have?old age? Citizens of retirement age in the Russian Federation can count on certain medical bonuses. Their main mass is set at the regional level.

Nevertheless, every retiree can count on:

As a rule, no registration of these benefits is required. It is enough to present an identity document, as well as a pension certificate, when contacting a medical organization.

What benefits do old age pensioners have in the Moscow Region? It is worth paying attention to a separate category of the population - labor veterans. So senior citizens can count on:

In the first case, it is enough to submit a pensiona certificate, in the second - to write an application to the relevant company (in the same way as it was described earlier), in the third - to provide the medical organization with documents indicating the status of the labor veteran, as well as the retirement age.

Benefits for old-age pensioners in MoscowApproximately the same ones are offered as in other regions. All citizens of retirement age may be exempt from paying personal income tax. No clearance of this bonus is required.

By law in Russia, the following cash flows of pensioners can be exempt from personal income tax:

Working pensioners, like all other workers, cannot get rid of the payment of personal income tax from their salary.

Следующий бонус - это не льгота, а возможность.It is offered to all working pensioners. We are talking about the design of parental leave. According to the laws of the Russian Federation, any close relatives can claim him (the father of the baby, grandmother, grandfather). If, for any reason, the mother of a newborn cannot care for him, the other person assumes this responsibility.

For registration of parental leave, you will need:

All documents are referred to the employer, after whichThe pensioner must be granted leave to care for the baby with all the corresponding benefits. In practice, this feature is not implemented very often.

As already mentioned, all the benefits can be divided into federal and regional. The latter vary depending on where the citizen lives. For example, residents of Moscow can hope for:

Previously, older people could count on free travel by public transport. But recently this benefit was canceled. It has been preserved only in some regions of the Russian Federation.

Some citizens get special opportunities after reaching a certain age. In Russia, retired people after 80 years are entitled to special benefits. Which ones?

Among them are:

It is clear what the benefits for old age pensioners for80 years laid. In addition to these bonuses, an elderly person can claim to care for themselves. Anyone can take care of the elderly - this period will be reckoned in the experience. This opportunity is currently used very actively in the country.

It is clear what benefits pensioners haveold age. Now you can find out how they are made. The bulk of state support is of a declarative nature - until the applicant informs about the intentions of using the right to a benefit, the relevant authorities will not provide it.

Let's start with registration of tax benefits. They are provided to the FTS at the place of registration of a citizen. Have to bring with you:

Этого будет достаточно.After studying the materials provided, the pensioner will be exempt from paying one tax or another. In order for the changes to take effect from the year of application, it is necessary to submit documents for consideration before November 1.

The next important point is the design of tax deductions. The process takes place in the FTS. To receive the deduction the pensioner needs the following documents:

This is usually enough. Tax deduction is granted for 4-6 months. This operation requires considerable waiting.

What benefits do old-age pensioners in Moscow and other regions promise in Russia? You can get housing if it is not. In this case, you will need to contact the city administration.

With a pensioner you need to bring:

From now on, it is clear what benefits pensioners have.old age in Russia. All state support is provided without any problems. The main thing is to prepare in advance all the necessary documents for this (and their copies).